- Home

- Sustainability

- Governance

Governance

As stipulated under the Act on Investment Trusts and Investment Corporations (“ITA”), API, as a J-REIT, is prohibited from having employees and entrusts its asset management operation to TRM, the asset manager.

API’s Corporate Governance

1. API’s Governance Structure

APIʼs organization comprises general meeting of unitholders, a board of directors currently comprised of one executive director and two supervisory directors, and an independent auditor. For the structure, please refer to the “API Structure”.

Unitholders’ Meeting

Board of Directors

Executive Director:

Nobuhide Kashiwagi

Supervisory directors:

Yoshinori Ariga

Kazuhiko Takamatsu

Independent Auditor

Ernst & Young ShinNihon LLC

2. Unitholders' Meeting

Matters and issues on API, that are originally stipulated in the ITA and other relevant laws & regulations, are to be resolved at the unitholders' meeting.

3. Executive Director and Supervisory Directors

The executive director represents API and is responsible for the administration of affaires of API. The supervisory directors have a statutory duty to review the executive director’s administration of API.

▶ Term of office and brief biographies of directors

The term of office for directors is two years. For the brief biographies of directors, please refer to “Management”.

▶ Eligibility requirements

Candidate for directors must not fall under any disqualification clause as defined in the ITA. Such candidates shall be examined and appointed at the general meeting of unitholders.

▶ Compensation

The articles of incorporation of API stipulate that it may pay the executive director up to ¥700,000 per month and each of our supervisory directors up to ¥500,000 per month, and the board of directors of API is responsible for determining the amount for each director. For the actual amount of compensation paid to the directors, please refer to the asset management report for the respective fiscal periods.

▶ Independence of supervisory directors

Pursuant to the provisions of the ITA, the supervisory directors are independent of TRM or its related parties, etc., and may request reports from TRM and the asset custodian on the status of the business and assets of API, or conduct necessary investigations as necessary.

4. Board of Directors

At the meeting of the board of directors, the executive director reports on the performance of its duties and the supervisory directors supervise to ensure that API operates the asset management in compliance with legal and regulatory requirements. The meeting frequency of the board should be at least once in three months as stipulated under internal regulations of TRM. However, actually it is held every month.

5. Independent Auditor

The independent auditor shall audit the financial statements of API and report to the supervisory directors any improper activity of the executive director. For the actual amount of compensation paid to the independent auditor, please refer to the asset management report for the respective fiscal periods.

TRM’s Corporate Governance

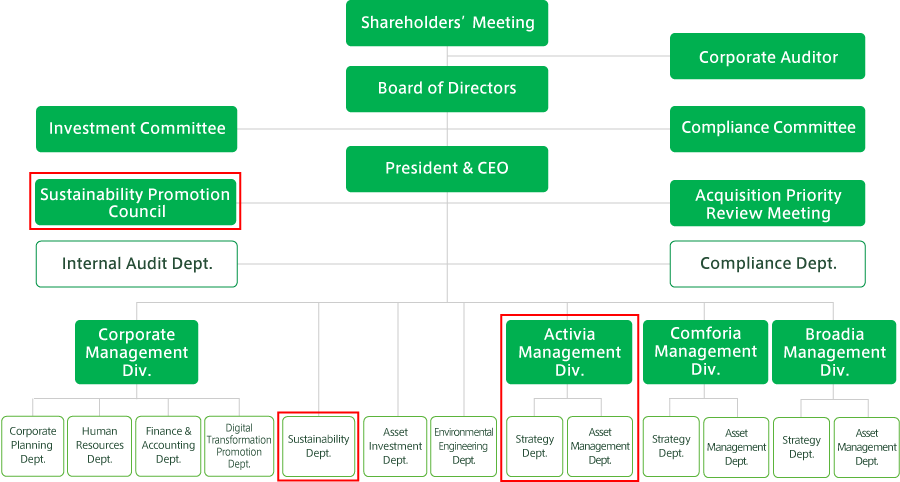

Under the management organization shown below, TRM exercises its asset management operation, and the Activia Management Division undertakes the management of assets of API. The Investment Committee and the Compliance Committee of which members include external experts deliberate matters related to asset management and compliance, and the Acquisition Priority Review Meeting determines the order of priority for consideration.

In April 2021, TRM established the rules on the sustainability promotion system to strengthen the system and expand the functionality of measures. Following this, the Sustainability Promotion Council obtained a more accurate position in the organization. The Sustainability Department succeeds the ESG-related missions from the Environmental Engineering Department, and we will further promote our sustainability program.

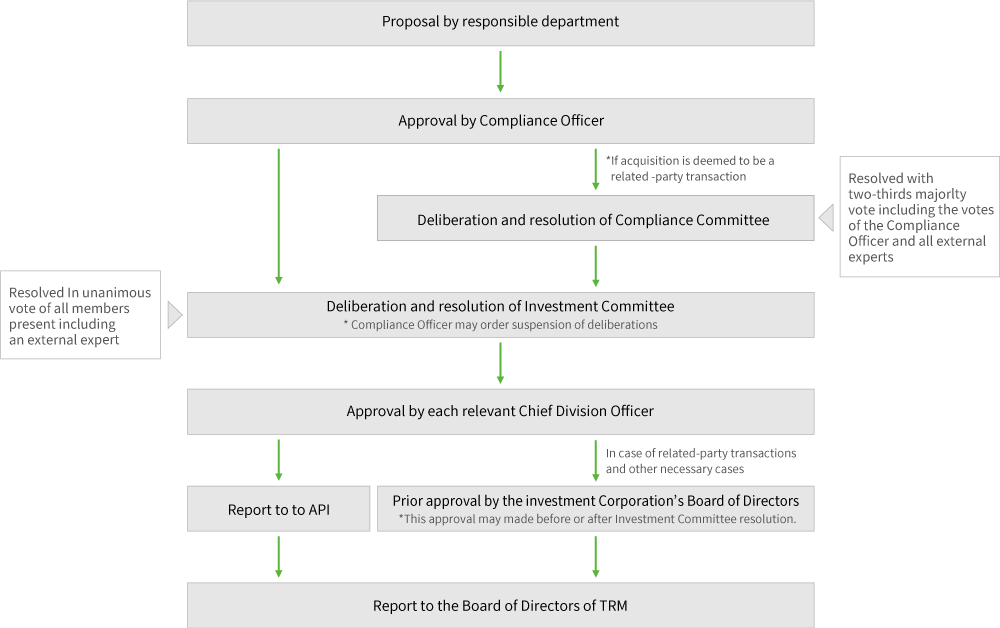

1. Decision Making Process

In order for API to make decisions concerning the acquisition or sale of assets or the operation and management of such assets, the Investment Committee of TRM shall, in principle, be required to pass unanimous resolutions on proposals, including the execution of acquisition of such assets and approval of the acquisition price, by the attending committee members with voting rights. In addition, TRM's legal compliance system and as a measure against conflicts of interest in transactions with related parties, in certain cases, deliberations and resolutions shall be made at TRM's Compliance Committee prior to resolutions at the Investment Committee.

2. Compliance Committee

| Members |

|

|---|---|

| Matters to be resolved |

|

| Deliberation | If two-thirds of the committee members including the Compliance Officer and all outside experts are present at the meeting, and two-thirds of the members who are present at the meeting including the Compliance Officer and all of the outside experts agree with the proposal, the proposal may be submitted to the Investment Committee. The Committee members may have observers present at the Compliance Committee meetings and ask for their opinions or explanations. |

3. Investment Committee

| Members |

|

|---|---|

| Matters to be resolved |

|

| Deliberation | Meetings of the Investment Committee in principle must be attended by all members with a voting right, and the Investment Committee approves a submitted proposal by a unanimous vote. A qualified independent real estate appraiser does not need to attend unless property value is an issue. If a qualified independent real estate appraiser cannot attend a meeting where property value is an issue, he/she may, instead of attending the meeting, submit an opinion, which must be respected upon a deliberation and vote. Any member of the Committee who has a particular interest in the subject proposal may not participate in the resolution. If the Compliance Officer determines that there is a problem with the course of deliberations, he/she may instruct the Investment Committee to suspend the deliberations. The Committee members may have observers present at the Investment Committee meetings and ask for their opinions or explanations. |

For the details of efforts to improve corporate governance in TRM, please refer to Efforts on Governance in TRM’s website.

Corporate Governance Structure to Maximize Unitholder Value

While leveraging the value-chain of TFHD Group, API and TRM are working to improve and enhance the governance system contributing to maximize unitholder value, including approaches such as measures against conflict of interests with related parties, alignment of interests of unitholders and TLC, and amendment to the AM fee structure with DPU-linked fee.

1. Acquisition Process Securing Fairness to Protect Unitholder Value

As described in TRM’s Corporate Governance, asset acquisition from related parties shall be resolved at the Compliance Committee which require two-thirds majority vote including the votes of the Compliance Officer and all external experts, prior to the deliberation and resolution at Investment Committee which require unanimous vote of all members present including an external expert. The proposal shall be approved then by the Board of Directors of API.

2. Alignment of Interests of API’s Unitholder and TLC

In order to align the interests of our unitholders with those of the Sponsor and with an aim to mutually increase our respective profitability by jointly conducting business, API and the Sponsor are agreed to the items below.

Ownership by the Sponsor

| Since IPO | the Sponsor maintains an approximately 10% equity interest in API. |

|---|

The Sponsor Support Agreement that TLC has entered into with TRM states that;

| 1. | When API makes its IPO of units, TRM has intention to acquire an approximately 10% equity interest in API. |

|---|---|

| 2. | TRM has intention to maintain the equity interest acquired in API directly or through another Sponsor-related company for a period of 5 years. |

| 3. | If and when API issues additional units, TRM sincerely considers a subscription of a part of such issuance. |

Under the COVID-19 environment, TLC obtained API’s additional investment units to reaffirm its intensive support to API.

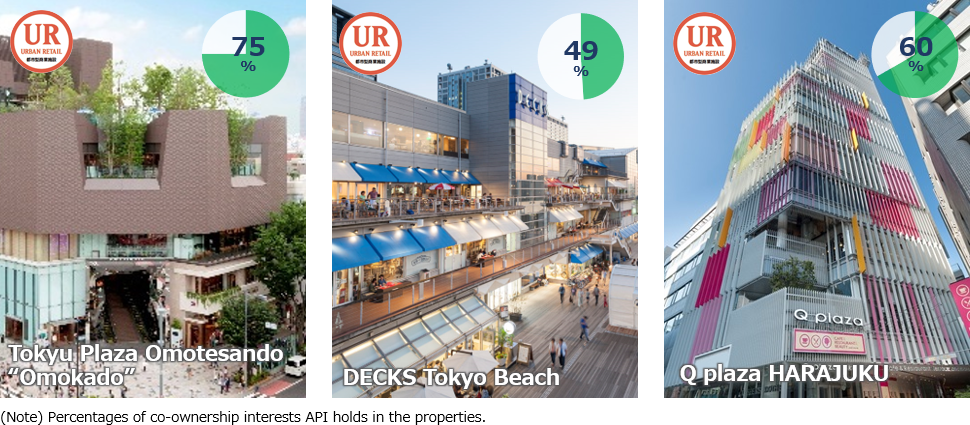

Co-ownership of certain properties with the Sponsor

We consider the co-ownership of properties with the Sponsor should enables us a management operation in each property further aligning the interests of our unitholders with those of the Sponsor.

3. Asset Management Fee Structure Including DPU-linked Fee

Pursuant to the asset management agreement, API pays an asset management fee including DPU-based portion to TRM. This structure is designed to incentivize TRM to enhance APIʼs unitholder value.

| Asset management fee | ||

|---|---|---|

| Type Ⅰ(per year) | Type Ⅱ | |

| Calculation method (Note) |

Total assets at end of the immediately preceding FP × 0.25% |

DPU (before deduction of the type Ⅱ management fee) × NOI × 0.00021% |

| Total AM fee of type Ⅰ and type Ⅱ is up to total assets at end of each period × 0.5% |

||

| (Note) | Type I management fee is up to 0.3% per year. |

|---|

| Acquisition fees / Disposition fees | |

|---|---|

| Acquisition fee | Disposition fee |

| 0.7% Transaction with a related party:0.5% |

0.5% No fee will be paid in the following cases 1) transaction with a related party 2) Transaction caused capital loss |

Compliance and Corporate Ethics

1. UN Global Compact

TFHD Group has stated its support for the UN Global Compact and TRM shares its support and respects the ten principles of the UNGC.

The 10 Principles of the UN Global Compact

| Human Rights |

Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights; and Principle 2: make sure that they are not complicit in human rights abuses. |

|---|---|

| Labour |

Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining; Principle 4: the elimination of all forms of forced and compulsory labour; Principle 5: the effective abolition of child labour; and Principle 6: the elimination of discrimination in respect of employment and occupation. |

| Environment |

Principle 7: Businesses should support a precautionary approach to environmental challenges; Principle 8: undertake initiatives to promote greater environmental responsibility; and Principle 9: encourage the development and diffusion of environmentally friendly technologies. |

| Anti-Corruption | Principle 10: Businesses should work against all forms of corruption, including extortion and bribery. |

2. TFHD Group’s Code of Conduct

TFHD Group recognizes that risk management through compliance management is the foundation of the Group's management, and we encourage all officers and employees to not only comply with laws and regulations but also to make decisions and take actions in accordance with the "Tokyu Fudosan Holdings Group Code of Conduct". As a member of the Group, TRM practices compliance management in accordance with the Code of Conduct.

- 1. Compliance with Laws and Regulations and Fair Trading

-

- Ensure compliance with applicable laws and regulations

- Ensure best practice in material procurement and fair trade

- Ensure compliance with fiduciary responsibility in the execution of duties

- Never connect with antisocial forces

- 2. Ensuring Customer-oriented Awareness

-

- Identify customer needs and develop products to meet their needs

- Prompt and dedicated response to customers’ comments and requests

- Customers’ safety and security comes first when providing products and services

- Provide a suitable and appropriate explanation and marketing of our products and services

- 3. Suitable Execution of Duties

-

- Responsible execution of duties, keeping concepts of “speed” and “evolution” in mind

- Nurture organization culture of placing emphasis on “Collective wisdom”

- Take advantage of combined strength of the corporate group

- Ensure proper decision-making process

- Proper management of rules

- Proper negotiations with business associates

- 4. Proper Management of Information

-

- Operate appropriate document and information management systems

- Proper management of confidential information and compliance with confidentiality obligation

- Prohibit insider trading

- Timely and appropriate information disclosure and PR activities

- Internal control to ensure proper accounting and financial reporting

- 5. Ensuring Good Faith in Business Conduct

-

- Preserve corporate assets

- Ensure a robust, safe, and comfortable working environment

- Respect human rights

- Contribution to society and consideration of the environment

- Reasonable business entertaining and gift-giving

- Clear distinction between business and personal matters

3. Corporate Compliance at TRM

TRM's management philosophy is to contribute to the development of society and maximize unitholder value through the provision of high-quality real estate investment management services and by earning the confidence of all stakeholders.

We aim to earn the trust of our unitholders by ensuring compliance with laws and regulations and acting with high ethical standards, and by providing transparent and easy-to-understand information disclosure from the standpoint of our unitholders, thereby contributing to the provision of high-quality real estate management services that meet the diverse needs of our tenants and the provision of total management services that bring together the know-how of TFHD Group.

In order to ensure compliance management and enhance corporate value, as well as to become a company that is trusted by all stakeholders including unitholders, all officers and employees of TRM (including directors, corporate auditors, temporary employees, and others who are not employed by the company) are required to use the Compliance Manual, an internal regulation, as a guide in their daily business activities, and each and every one of them is required to comply with the standards of conduct stipulated in the Manual.

TRM considers compliance to be not only a matter of legal observance but also a broader concept, as described below, in accordance with the above-mentioned management philosophy, which is to be practiced by each and every officer and employee with awareness, thereby fulfilling corporate social responsibility.

- Legitimate actions in compliance with laws and regulations (including supervisory guidelines, financial inspection manuals, etc.)

- Risk management behavior in compliance with internal rules and regulations

- Exemplary behavior that conforms to our corporate philosophy

- Ideal behavior based on social norms and high ethical standards

Directors recognize compliance as the most important issue in management and are responsible for maintaining and improving the management environment for compliance by establishing basic compliance-related policies and internal rules, etc. Their main roles are as follows;

- Formulation and resolution of basic policies and internal rules, etc. related to compliance

- Direct activities based on the compliance program

- Maintenance of compliance environment and internal control system

Auditors of TRM have the role and responsibility to audit whether directors' decisions and their execution are legal, appropriate, and effective.

Compliance and business ethics training for employees

TRM conducts a wide range of compliance and business ethics training for all employees.

<Example of trainings in fiscal year 2021>

- Compliance training

Introduction to financial regulations / Conflict of interest transaction management (including management of contractors) / Information management (personal information, insider trading regulations, etc.) / Preventing relationships with antisocial forces (including anti-money laundering) - Compliance training for new employees

- Insider trading regulation seminar

- Risk management training (on upgrading risk management systems)

- Seminar on harassment prevention "Unconscious bias x anger management”

- Revised Personal Information Protection Law x DX strategy

Fraud and Corruption Prevention

1. Prevention of Relationships with Anti-Social Forces

TRM sets forth a basic principles and specific measures to be taken in the "Standards for Anti-Social Forces" to ensure that TRM and API do not have any relationship with anti-social forces, to ensure proper management, to prevent significant damage to stakeholders including officers, employees, etc. and shareholders, and to fulfill the company's social responsibility.

2. Anti-Money Laundering Prevention System

TRM recognizes the importance of preventing money laundering, financing of terrorism and financing for the proliferation of weapons of mass destruction ("money laundering, etc.") and conducts annual hearings on the prevention systems of its business partners.

TRM strives to prevent API, TRM, as well as their clients, business partners, etc., from involvement in money laundering, etc., and to contribute to the sound maintenance and development of the financial system.

3. Whistleblower System

TRM has the Compliance Helpline Counter as a contact point to report and consult on compliance matters including when harassment and bullying is experienced or observed, enabling all officers and employees to directly report to the Compliance Officer of TRM, General Manager of Legal Affairs Department of TLC, General Manager of Group Legal Affairs Department of TFHD Group, or external attorneys. Also, a system is in place to structurally protect the whistleblowers when such reports were conducted.

Risk Management

1. Risk Management System

TRM sets forth a basic policy for risk management based on its strategic objectives and appropriate risk management to be taken in the "Risk Management Regulations", and has appointed the Compliance Department, consisting of an officer and employees who do not concurrently serve in the business division, as the risk management division, and the Compliance Officer as the risk management manager who oversees this department. The Compliance Department and the Compliance Officer promote the advancement of risk management systems with the support of external experts. The risk management manager is responsible for the effectiveness of appropriate risk management, and reports directly to the President & CEO and the Board of Directors of TRM on the design and management of the organization-wide risk management system and the risk management policy formulated each year. Directors shall establish risk management policies and disseminate them throughout the organization.

TRM also works to improve the risk management skills of its employees by providing risk management training.

2. Information Security

In order to protect the information assets held by TRM and ensure their proper use, TRM has established the "Basic Rules for Information Security Management" to clarify the responsibilities at TRM regarding information management and to define basic information security measures to be implemented.

By continuously practicing these measures, TRM strives to ensure the trust of its stakeholders, including API that entrusts its asset management operations to TRM, and thereby fulfill TRM's corporate social responsibility.

In preparation for the occurrence or emergence of serious risks related to the company's information security, TRM has appointed a chief information security management officer (a Director in charge of information security), an information security management officer (General Manager of the Corporate Planning Department), an information system management officer (General Manager of the Digital Transformation Promotion Department), and an information security manager at each division (Chief Division Officer or General Manager of the division), to ensure a system to report to the Board of Directors without delay.