- Home

- Sustainability

- Environmental

Environmental

Initiatives to Reduce Environmental Impact

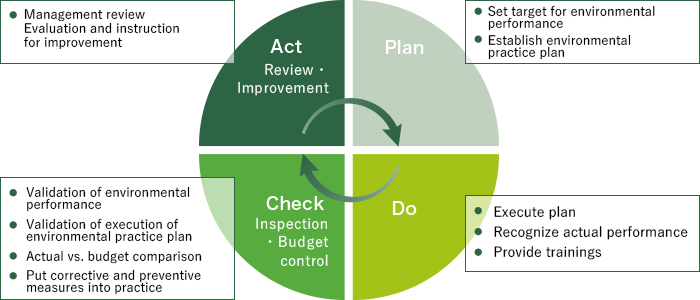

1. Environment Management System

TRM established a unique environment management system (EMS) which applies PDCA cycle to continuously approach to environmental challenges. We are working to continuously reduce environmental impacts in the management operation for API, through the cycle of four steps; set targets (Plan), assess performance (Do), analyze budget vs. actual (Check), and implement countermeasures for a better performance (Act). The Asset Management Department of Activia Management Division in TRM reviews actual performances in its monthly meeting and reports the results to the management once a year, then receives feedbacks and instructions for further improvement for the following year, from the management.

API is ISO 14001 certified for its EMS for real estate investment management and property management.

In accordance with the ISO standard, we are committed to implementing a range of initiatives based on below policies.

- We will comply with environmental laws, regulations, ordinances, agreements, and other requirements, and strive to reduce environmental impact and prevent environmental pollution.

- We will develop and foster human resources as a group of professionals by promoting development of each employee by setting forth the requirements for ideal profile.

- We will raise employees' awareness of environmental conservation through environmental education and awareness-raising activities, and actively contribute to local environmental protection activities.

- We will promote reduction, proper disposal, and recycling of waste.

- We will strive to continuously improve our environmental protection activities by setting and periodically reviewing environmental targets.

| Standard: | ISO14001:2015, JIS Q 14001:2015 |

| Scope: | Real estate investment management and property management |

| Certification body: | EQA International Certification Center Co., Ltd. |

| Registration no.: | EA220076 |

2. Green Procurement Standards

As a member of TFHD Group (the “Group”), TRM shares the Group’s “Sustainable Procurement Policy” published on January 31, 2020 and works on challenges to environmental crisis such as climate change. Our objective is to work on this goal, together with all the stakeholders including our suppliers.

In line with the Group’s procurement policy, TRM established the “Green Procurement Standard” to translate the policy into practical measures.

This standard broadly states to suppliers that environment-friendly procurement is to be carried out, and together with them, TRM works to promote more sophisticated efforts based on the Policy.

The scope of application of this standard includes direct or indirect transactions related to products, services, raw materials, and design/construction procured by TRM and API.

When conducting bidding for large-scale repair and maintenance work for properties under management, the "Green Procurement Standards" and a reference table are attached to the quotation guidelines to promote environmentally friendly construction work. In addition to the use of environmentally friendly products, TRM actively encourages suppliers to make technical recommendations to conserve energy from the planning stage through the PM (property management) company for the works such as replacement of air conditioning and lighting fixtures.

3. Environmental Impact Reducing Works

In accordance with the medium- to long-term asset management plan and the Green Procurement Standards, in every fiscal period, API undergoes engineering works to reduce environmental impacts such as installation of LED lightings and energy-saving air-conditioners. Not only common areas, but tenant spaces also get renovated occasionally in the event of the tenant replacements.

Air-conditioning equipment replacement at Commercial Mall Hakata in the period ended May 2022

In the renewal work of air-conditioning equipment in the common areas and backyard, TRM presented its “Green Procurement Standards” to the contractor in advance and received technical proposals for reducing environmental concerns. As a result, the contractor selected a model that meets the “Guidelines for Formulating Premium Standards" established by the Ministry of the Environment, and CO2 emissions were reduced by 37%.

- LED lightings

-

Conversion to LED lightings at A-PLACE Aoyama (FP November 2022)

Reduced power consumption of lighting fixtures in the worked area by approximately 50%.

- Air-conditioner

-

Air-conditioning equipment renovation at Osaka Nakanoshima Building (to be completed in FP May 2025)

Installed a new BEMS (Building Energy Management System) to visualize the energy consumption of the entire building and achieve optimal energy management.

Plans call for a 31.2% reduction in primary energy and a 40.1% reduction in CO2 emissions.

- Toilet

-

Toilet urinal renewal work at Umeda Gate Tower (to be completed in FP May 2023)

Approximately 20% water saving from existing fixtures.

- Elevators and escalators

-

Elevators replacement at A-FLAG KOTTO DORI (to be completed in FP May 2024)

Power consumption from elevator operations to be reduced by about 85% and carbon dioxide emissions by about 75%.

- Other

-

Renovation of exterior walls and guest room windows at A-FLAG SAPPORO (to be completed in FP May 2024)

Adoption of Low-E double-glazed window glass to reduce annual energy consumption by about 38% due to air conditioning operation in guest rooms.

For other initiatives in collaboration with suppliers, please refer to “Supplier Engagement”.

4. Green Lease Agreement

API and its tenants have concluded agreements which includes the Green Clause and share the importance of preservation and improvement of the comfort and productivity of tenants and properties. The Green Clause states that they should share information and work together for green certification acquisition, environmental target setting, response to environmental regulations, etc.

API and one of its tenants have signed a memorandum of understanding on the Green Lease linked to refurbishment works. It stipulates that when the tenant enjoys profit from energy-saving effect of the refurbished equipment API invested in, the tenant shall return a reward to API.

In addition, we have set a KPI of 100% Green Clause in new lease contracts. For the progress of the KPI, please refer to “KPIs and progress towards targets” in "Environmental Performance".

For other initiatives in collaboration with tenants, please refer to “Tenant Engagement”.

Addressing Climate Change

1. How We Look at and Address Climate Change

(1) Our perception of and basic approach to climate change

We are well aware that climate change is a critical issue that has a great impact on our business activities.

The Sixth Assessment Report of the Intergovernmental Panel on Climate Change (IPCC), published in 2021, firmly concludes that humans have warmed the atmosphere, ocean, and land. The report attributes increases in greenhouse gas (hereinafter refers to as “GHG”) concentrations including carbon dioxide since around 1750 to human activities such as heavy consumption of fossil fuels.

At the 26th United Nations Climate Change conference (COP26) also held in 2021, participating countries formally agreed that they will pursue efforts to limit temperature increase to 1.5℃. This agreement came amid growing awareness that limiting the increase in the global temperature to 2℃ above levels in the Industrial Revolution--the maximum allowable level under the Paris Agreement of 2015--will not preclude tremendous negative impacts. Given the global temperature has already risen by more than 1℃, however, we believe that achieving this target requires bold actions, including social and structural changes.

Given such circumstances, we recognize the importance of efforts to achieve the Japanese government’s goal of attaining net zero GHG emissions by 2050. (“Net zero” refers to a balance between anthropogenic emissions and their removals. The same applies hereinafter.)

We need to adapt to emerging waves of change generated by these increasing impacts of climate change, more solid global frameworks for climate change, and transition to a decarbonized society. We also need to secure both stable earnings and steady growth in assets under management over a medium to long term. To these ends, it is important for us to predict risks and opportunities that climate change may present to our business, to work with our investors and other stakeholders, and to reflect such risks and opportunities in our investment strategies and property management.

TRM, to which API entrusts the management of its assets, is mindful of the need for environmental and social considerations and strong governance. And, as a member of the Tokyu Fudosan Holdings Group (hereinafter referred to as “the Group”), TRM shares the Group’s Sustainability Vision. The Group has a goal of net zero CO2 emissions by 2050 (hereinafter referred to as “net zero policy”) for itself and its supply chains as one of its climate targets.

TRM believes that addressing these needs constitutes part of its social responsibilities and is also an avenue to practice its management philosophy. It also believes that doing so will contribute to development of a sustainable society. To put this belief into practice, TRM has identified material issues under its Sustainability Policy and shares them with API. For more information on the Sustainability Policy and the material issues, please refer to TRM’s Sustainability Initiatives.

The escalation of climate change has a huge impact on our efforts toward “reducing environmental impact,” one of our material issues. For this reason, we demonstrate to our suppliers our commitment to environmentally preferable purchasing with our Green Procurement Standards, established in September 2020. We join hands with our suppliers in taking action based on mutual understanding.

To redouble its efforts to address these issues, TRM has signed on to the Principles for Responsible Investment (PRI), joined GRESB as a member, and embraced the UN Global Compact (UNGC) in conducting business activities.

(2) Support for the TCFD recommendations

TCFD stands for “Task Force on Climate-related Financial Disclosures,” a unit established by the Financial Stability Board (FSB) at the request of the G20. With the recognition that climate change poses a serious risk to the global economy, the TCFD is tasked with examining how climate-related information should be disclosed as well as what action should be taken on the part of financial institutions.

In January 2022, TRM announced its support for the TCFD Recommendations and is now a member of the TCFD Consortium, an association of Japanese businesses that endorse the recommendations.

2. Organizational Governance for Addressing Climate Change

(1) Our structure to promote sustainability

For information on the implementation setup at TRM (including responses to climate change; hereinafter the same), please refer to Our Structure to Promote Sustainability.

(2) Sustainability Promotion Council

As part of its efforts to address sustainability issues, TRM convenes the Sustainability Promotion Council regularly to share sustainability-related information (including responses to climate change) and discuss measures to take on these challenges and implement them. The Council also monitors progress in our sustainability efforts regularly and continuously. For more information about the Council, please refer to “Sustainability Promotion Council” under “Our Structure to Promote Sustainability.”

(3) Our ISO 14001-certified environment management system

API and TRM have in place a unique environment management system (EMS) that builds on a PDCA cycle to reduce environmental impacts of their business, including the management of properties owned by API. Using this framework, we have been making efforts to manage and promote sustainability initiatives. These efforts include holding regular divisional meetings and reporting to management, and as needed, to the Sustainability Promotion Council. In April 2022, this particular EMS was certified to have met the international standard in two categories of service: real estate investment management and proprietary property management. For information on how API uses the EMS in asset management, please refer to “Environment Management System” under “Initiatives to Reduce Environmental Impact.”

(4) Climate Action Standards

For matters related to addressing climate change, TRM has in place a set of climate action standards, under which it has built its structure to promote sustainability and established an action policy that builds on the TCFD framework. To reduce the impact of GHG emissions on climate change, TRM, as a member of the Group, sets climate indicators and targets under the net zero policy. For information on the management of risks and opportunities related to climate change, see “Managing Risks and Opportunities Related to Climate Change.”

(5) Reporting on performance

For information on TRM’s structure for reporting and monitoring related to sustainability, please refer to Our Structure to Promote Sustainability.

| Meeting entity | Convening entity | Frequency |

|---|---|---|

| ESG meeting at Activia Management Division | TRM | Three times or more a year |

| Sustainability Promotion Council | TRM | Four times a year |

| TRM’s Board of Directors meeting | TRM | Once a year (reporting) |

| API’s Board of Directors meeting | API | As needed (reporting) |

3. Strategy That Factors in Risks and Opportunities Related to Climate Change

In developing a strategy that factors in risks and opportunities related to climate change, API has conducted the following scenario analyses under the net zero policy, which builds on the climate action standards.

(1) Scenario analysis assumptions

Climate change risks can be largely divided into transition risks and physical risks. API has analyzed three scenarios: 1.5℃, below 2℃, and 4℃ scenarios, using future climate predictions announced by two international organizations*. These scenario analyses have used two timeframes during which we will continue to be affected: mid-term (2030) and long-term (2050).

| * | International Energy Agency (IEA), World Energy Outlook 2022 UN Intergovernmental Panel on Climate Change (IPCC), The Sixth Assessment Report (AR6) |

|---|

Global outlook under the 4℃ scenario

A scenario in which GHG emissions are high due to a lack of progress in decarbonization action, resulting in more frequent natural disasters. Physical risks, rather transition risks, need to be addressed.

This table can be scrolled sideways.

- Climate, Natural Environment

-

- A 4.5℃ rise in annual mean temperature in Japan from the 20th to 21st centuries

- More frequent violent typhoons toward the end of the 21st century

- About a fourfold increase in flooding frequency in Japan by the end of the 21st century compared with the 20th century

- More frequent storm surges due to a sea level rise of 0.45–0.82 m on global average caused by global warming

- Policies, Laws & Regulations

-

- No progress in decarbonization policy from the present

- No strengthening of such systems as carbon taxes and emissions trading as well as of energy efficiency standards for buildings

- Tighter laws and regulations on disaster prevention and reduction

- Mild improvement in energy efficiency of existing properties

- Investors, Financial Institutions

-

- The established practice of factoring in physical risks in making investment decisions despite a measure of increase in ESG investment

- Integrated or standards criteria not available despite more diversity in green finance mechanisms

- API

-

- Rising costs of addressing floods and localized torrential rains

- Operating losses due to cessation of operations resulting from damage to properties caused by natural disasters

- No notable increase in construction and refurbishment costs as demand for constructing ZEBs and converting to ZEBs remains low

- More burden on PM, BM, and AM companies due to the need to procure emergency supplies, implement BCP, and conduct disaster response drills

- Tenants, Customers,

Local Communities -

- More considerations paid to the health, comfort, and safety of tenants and customers (measures to prevent heat stroke, BCP, etc.)

- 3.2-fold increase in the per capita cost of air conditioning (to 61 dollars) from the current level due to rising mean temperatures

- Closer cooperation with local communities in times of disaster

Global outlook under the below 2℃ and 1.5℃ scenarios

A scenario in which GHG emissions are curbed thanks to various environmental regulations and more ZEBs. Transition risks, rather than physical risks, need to be addressed.

This table can be scrolled sideways.

- Climate, Natural Environment

-

- A 1.4℃ to 1.7℃ rise in annual mean temperature in Japan from the 20th to 21st centuries

- The frequency and intensity of typhoons largely unchanged from the current level

- About a twofold increase in flooding frequency in Japan by the end of 21st century compared with the 20th century

- A sea level rise of 0.26–0.55 m on global average caused by global warming

- Policies, Laws & Regulations

-

- ZEBs being the standard for new constructions

- A rise in the average carbon price in developed countries up to 250 dollars per tonne by 2050 with the introduction of a carbon tax and emissions trading

- Scale-up of environmental standards and disclosure policies associated with improved environmental literacy

- Investors, Financial Institutions

-

- More emphasis on regulatory compliance and environmental certification

- Higher procurement costs for properties with low environmental or fire-resistant performance as investors consider ESG in making decisions and environmentally certified properties constitute a larger percentage of the investment portfolio

- Performance in addressing environmental impacts required as an essential appraisal criterion with green finance mechanisms in place

- API

-

- ZEBs accounting for 100% of new constructions and more than 85% of existing properties from 2030 onward; an increase in capital investment for achieving these targets being reflected in acquisition costs

- A reduction of 40% in energy use from compared with 2020 due to more ZEBs, resulting in lower utilities expenses

- Additional operating expenses for complying with stricter laws and regulations, demonstrating environmental actions to stakeholders, and improving disclosures

- Lower income from rentals of properties with low environmental or fire-resistant performance

- More work to comply with stricter laws and regulations at PM, BM, and AM companies

- Tenants, Customers,

Local Communities -

- Tenants’ preference for properties with high environmental or fire-resistant performance; lower demand for those with low environmental or fire-resistant performance

- Only 1.8-fold increase in the per capita cost of air conditioning (to 35 dollars) from the current level despite rising mean temperatures

- Communication with local communities about disaster response playing a key role

(2) Analytical procedure

The analysis of the 4℃ scenario, which assumes a world in which physical risks need to be addressed more than transition risks, has involved identifying and analyzing long-term (2050) risks, which outweigh mid-term (2030) risks. The analysis of the below 2℃ and 1.5℃ scenarios, which assumes a world in which transition risks need to be addressed more than physical risks, has involved identifying and analyzing both mid-term (2030) and long-term (2050) risks and opportunities for each scenario. In both analyses, financial impacts have been analyzed and assessed both quantitatively and qualitatively.

The analyses, both qualitative and quantitative in nature, have been conducted in light of the status of API's asset holdings, with reference made to currently available scenarios as published by the IEA and the IPCC and to objective projections published by other third-party specialized institutions. The impact assessments thus made assume some risk factors and their uncertainties; therefore, they do not guarantee their accuracy or safety that they may suggest.

| Risk Category | Type | Item | Description of Risks and Opportunities | Category | Financial Impact | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Under the 4℃ scenario | Under the below 2℃ and 1.5℃ scenarios |

|||||||||

| 4℃ | Below 2℃ | 1.5℃ | ||||||||

| 2030 | 2050 | 2030 | 2050 | 2030 | 2050 | |||||

| Transition Risks |

Policies, Laws & Regulations | Increased pricing of GHG emissions | Cost arising from carbon tax levy | Risk | Minor | Moderate | Minor | Moderate | ||

| Higher efficiency due to shift to properties with higher eco performance | Opportunity | Minor | Minor | Minor | Minor | |||||

| Mandates on and regulation of existing products and services | Increased construction costs arising from compliance with ZEB-related and other environmental regulations | Risk | Minor | Major | Minor | Major | ||||

| Increased verification costs arising from compliance with ZEB-related and other environmental regulations | Risk | Minor | Minor | Minor | Minor | |||||

| Higher efficiency due to shift to properties with higher eco performance | Opportunity | Minor | Minor | Minor | Minor | |||||

| Technology | Substitution of existing products and services with lower emissions options | Increased costs arising from introduction of new technologies | Risk | Minor | Major | Minor | Major | |||

| Higher efficiency due to shift to properties with higher eco performance | Opportunity | Minor | Minor | Minor | Minor | |||||

| Market | Changing customer behavior | Higher vacancy of properties with lower environmental performance | Risk | Minor | Minor | Minor | Minor | |||

| Lower demand due to little shift to properties with higher fire-resistance | Risk | Minor | Minor | Minor | Minor | |||||

| Shift to high-efficiency properties | Securing competitive edge by shifting to properties with higher environmental performance | Opportunity | Major | Major | Major | Major | ||||

| Reputation | Increased stakeholder concern or negative stakeholder feedback | Divestment or poor access to capital markets | Risk | Minor | Minor | Minor | Minor | |||

| Changing customer behavior | Lower demand due to little shift to properties with higher fire-resistance | Risk | Minor | Minor | Minor | Minor | ||||

| Physical Risks |

Acute | Increased severity of extreme weather events | Costs incurred from the need to address torrential rain disasters, etc. | Risk | Moderate | |||||

| Loss of sales opportunities due to torrential rain disasters, etc. | Risk | Minor | ||||||||

| Chronic | Rising mean temperatures and sea levels | Increased costs of air conditioning due to rising temperatures | Risk | Minor | ||||||

| Inundation due to sea level rise | Risk | Minor | ||||||||

| (Note) | Risks are represented in orange and opportunities in blue. The scale of the financial impact (minor, moderate, major) is expressed by the depth of color: the deeper the color is, the larger the impact is. |

|---|

(3) Analysis findings

Both the below 2℃ and 1.5℃ scenarios entail substantial transition risks. In these two scenarios, the introduction of a high carbon tax designed to curb CO2 emissions in Japan is likely to mean higher operational costs stemming from, for example, a heavier tax burden on CO2 emissions from proprietary properties. Stricter environmental regulations with regard to ZEBs, energy saving standards, and the like are likely to translate into additional costs of refurbishments needed to comply with them.

Tighter regulations will have a tremendous impact on tenants’ choice of properties. It is expected that in comparing properties of different real estate agencies, demand for properties with lower energy efficiency will decline.

With an eye on a transition to a decarbonized society under the scenario of below 2℃, API is committed to addressing these risks and maintaining its competitive edge. To these ends, API will take a number of actions. These include deploying renewables, switching over to LED lighting in a systematic manner, and retrofitting its properties with more energy efficient equipment. To make its portfolio greener, API will also increase the proportions of environmentally certified properties and green lease agreements with new tenants.

Under the 4℃ scenario in which little progress will be made in decarbonization, API expects damage to its proprietary properties due to increased severity of extreme weather events and resultant increases in repair expenses. It is worth noting here that API' buildings are originally disaster-resistant and that API's investment focuses on properties in areas resistant to inundation and other risks. With regard to chronic changes such as rising mean temperatures, API is committed to reducing CO2 emissions by, for example, deploying renewables and considering and replacing existing key equipment such as electric and air conditioning equipment with more energy-efficient equipment wherever possible when it reaches its end of life.

It is worth noting that these analyses (published in July 2023) did not find any marked changes from the previous analyses (published in July 2022) or any matters of significant concern. It is unlikely that there will be major changes to the trends concerning the above scenarios. Accordingly, API will continue with what it has been doing.

(4) Addressing Physical Risk

Japan is prone to natural disasters. Its geographical factors expose it to inundation and other damage due to typhoons and torrential rains. Earthquakes are frequent as well. API has in place a structure that minimizes such damage and enhance resiliency to intensifying disasters to reduce the risk that disasters will erode portfolio profitability. TRM has a business continuity management (BCM) policy on crisis response and business continuity planning (BCP) under its basic policy on risk management.

Progress in global climate change may make natural disasters more frequent and destructive. API regards an increasing financial impact of such disasters as a major physical risk of climate change. Please see Preparation for Disasters for our preparedness for disasters.

Predicting flood risks

API keeps abreast of possible flood damage to its portfolio with the help of hazard maps prepared by the Ministry of Land, Infrastructure, Transport and Tourism and local governments. (API uses information on flood and inundation hazard areas as well as storm surge and inundation hazard areas.)

To minimize economic losses, API makes necessary Preparation for Disasters for its properties and has a fire insurance that covers flood losses in place for each of them.

Please check earthquake PML in “Financial Statements”.

| Flood Depth (m) | Urban Retail Properties | Tokyo Office Properties | Activia Account | Total (building) (Note) |

|---|---|---|---|---|

| Over 5.0 | 0 | 0 | 0 | 0 |

| 3.0 to 5.0 | 0 | 0 | 2 | 2 |

| 0.5 to 3.0 | 5 | 9 | 3 | 17 |

| 0 to 0.5 | 4 | 2 | 2 | 2 |

| No damage expected | 3 | 8 | 4 | 15 |

| Total | 12 | 19 | 11 | 42 |

| (Note) | Number of buildings as of November 30, 2022. Excluding properties for sale. |

|---|

4. Managing Risks and Opportunities Related to Climate Change

Matters related to material issues regarding climate-related risks and opportunities and adaptation and resilience to climate change are regarded by TRM as matters related to climate action in accordance with its climate action standards. They also constitute specific sustainability initiatives and are therefore part of the matters related to promoting sustainability.

In January 2022, we announced our support for the TCFD Recommendations, which prompted us to conduct scenario analyses described above. The analyses were aimed at identifying risks and opportunities arising from the impact climate change may have on API, assessing the impacts of these risks and opportunities on our business, and making changes to our future strategies as needed. Risks of particular importance were singled out in light of how likely they emerge, when they emerge if ever, and how they may impact our finances.

Based on the analysis findings, we will review and further improve our initiatives. To this end, we will execute function management with the help the EMS and monitor API's actions and their progress through the Sustainability Promotion Council.

5. Setting Metrics and Targets Related to Climate Change

(1) Metrics and targets

API has identified its metrics and targets related to climate change under the category of “reducing environmental impact,” one of the material issues it shares with TRM. For the purposes of identification, API assessed risks and opportunities presented by the impacts of climate change as well as the importance of specific actions aimed at addressing these impacts.

API has also set out a policy for reducing environmental impact. The policy covers four key areas: energy use, energy-related CO2 emissions, water conservation, and waste generation. To translate the policy into specific actions, API has set the following key performance indicators (KPIs) for climate action under the net zero policy, which builds on TRM’s climate action standards. These KPIs are classified into three categories, which include the existing two categories of renewable energy procurement and portfolio greening as well as the new category of sustainable finance, with the KPI in this category being the percentage of green bonds.

Renewable energy procurement

- Complete transition to renewable electricity in all portfolio properties* by the end of March 2026

- 100% reduction of CO2 emissions generated by electricity by the end of March 2026, relative to a FY2015 baseline

| (Note) | Excluding co-owned, sectionally owned, and land-only properties that have not installed renewable electricity. |

|---|

Portfolio greening

- Green-certified assets: 70% or more green-certified assets by 2030

- Green leases:Promote green leases for 100% of new contracts

| (Note 1) | Green-certified assets refer to the properties to CASBEE Certification for Real Estate, BELS Certification, Tokyo Low-Carbon Small and Medium-Sized Model Building, and DBJ Green Building Certification. |

|---|---|

| (Note 2) | The figure is calculated based on the gross floor areas of the properties excluding those in which API owns only land. |

| (Note 3) | API promotes to include green clauses in lease contracts with tenants in light of the need for energy efficiency and environmental considerations, thus sharing with them its ideals for improving and maintaining building-wide comfort and productivity. |

Sustainable finance

- 100% of new issuances of investment corporation bond to be green bonds%

| (Note) | On the condition of issuance based on the current framework. |

|---|

(2) Progress toward targets as well as practices

API regularly discloses information on its website, etc. on environmental performance with regard to energy consumption, CO2 emissions, water consumption, and waste generation; environmental certifications; and environmental impact reducing works. It also provides relevant information on the annual sustainability report and financial statements as part of ESG-related information.

Environmental Performance

| FY2015 (Base year) |

FY2019 | FY2020 | FY2021 | FY2022 | % change (vs FY2021) *Like-for-like comparison for intensities (vs FY2021) |

||

|---|---|---|---|---|---|---|---|

Energy consumption per year (Note 2) |

Actual (MWh) |

86,660 | 116,744 | 48,774 (107,339) |

39,716 (106,030) |

39,121 (103,770) |

98.5% (97.9%) |

| Intensity (MWh/㎡) |

0.23 | 0.21 | 0.29 (0.20) |

0.23 (0.19) |

0.23 (0.19) |

97.6% (99.5%) |

|

| Total renewable electricity (MWh) | 0.05 | 0.02 | 0.14 | 913 | 21,357 | 2339.1% | |

| Renewable electricity generation (MWh) |

0.05 | 0.02 | 0.14 | 0.10 | 0.09 | 98.4% | |

| Renewable electricity purchased (incl. Non-fossil certificate) (MWh) |

- | - | - | 913 | 21,357 | 2339.4% | |

CO2emissions per year (Note 3) |

Actual (t-CO2) |

34,197 | 45,347 | 40,683 | 41,182 | 31,513 | 76.5% |

| Scope 1 (direct emission) |

- | - | 1,465 | 1,699 | 1,710 | 100.6% | |

| Scope 2 (indirect emission) |

- | - | 18,037 | 13,551 | 10,887 | 80.3% | |

| Scope 3 (emission from tenants) |

- | - | 21,181 | 25,932 | 18,917 | 72.9% | |

| Intensity (t-CO2/㎡) |

0.093 | 0.083 | 0.116 (0.07) |

0.086 (0.07) |

0.073 (0.06) |

85.1% | |

Water consumption per year |

Actual (㎥) |

526,515 | 701,847 | 443,885 | 440,732 | 479,312 | 108.8% |

| Intensity (㎥/㎡) |

1.42 | 1.29 | 0.82 | 0.80 | 0.89 | 110.5% | |

| Recycled water (Grey Water and Drainage)(㎥) |

- | 30,678 | 15,549 | 13,292 | 21,012 | 158.1% | |

| Waste generation per year (t) (Note 4) |

2,824 | 4,367 | 2,899 | 2,558 | 2,652 | 103.7% | |

| (Note 1) | Principally the figures shown above are the cumulative amounts of the entire portfolio (excluding those in which API owns only land) during each fiscal year. (Number of properties: FY2015:30, FY2016:37, FY2017:40, FY2018:42, FY2019:43, FY2020 : 41, FY2021:45, FY2022:46) |

|---|---|

| (Note 2) | The figures shown are total amount of consumption fuel (gas, heavy oil, etc.), electricity and district heating / cooling of the properties. From FY2020, the actual amounts cover the area of the properties for which API has operational control of energy consumption. Figures in parentheses include emissions by tenants, same as the previous fiscal years. |

| (Note 3) | The factor and the method applied to the calculation are in accordance with “GHG Emissions Accounting, Reporting and Disclosure System” of the Ministry of the Environment. Figures reported as Scope 3 fall under category 13 and are limited to the data which was able to be collected from tenants. Figures for intensity from FY2015 to FY2019 as well as those in parenthesis from FY2020 are calculated based on the total area of the properties with reference to the occupancy. Figures from FY2020 are total of the intensity for Scope 1 and 2, calculated based on the common area of the properties. |

| (Note 4) | Excluding waste directly generated by tenants. Figure for FY2016 excludes properties of which data were not available (Figure represents 91.5% of the entire portfolio). |

Third-party assurance statement

- Jun. 30, 2023

- Independent Assurance Statement PDF(PDF:132KB)

- Jun. 30, 2022

- Independent Assurance Statement PDF(PDF:117KB)

- Jun. 25, 2021

- Independent Assurance Statement PDF(PDF:322KB)

KPIs and Progress toward Targets

Renewable energy deployment

- Target

Complete transition to renewable electricity in all portfolio properties* by the end of March 2026 - Excluding co-owned, sectionally owned, and land-only properties that have not installed renewable electricity.

| End of May 2022 (reference) |

End of May 2023 | End of November 2023 | End of March 2026 (target year) |

|

|---|---|---|---|---|

| Number of properties (Note) | 41 | 41 | 40 | - |

| Number of properties deployed renewable electricity | 4 | 13 | 13 | - |

| Rate of renewable electricity deployment (GFA based) |

18% | 33% | 33% | 100% |

| (Note) | Excluding co-owned, sectionally owned, and land-only properties that have not installed renewable electricity. |

|---|

CO2 emissions from electricity

- Target

100% reduction of CO2 emissions from electricity by the end of March 2026, relative to a FY2015 (April 2015 to March 2016) baseline - Excluding co-owned, sectionally owned, and land-only properties that have not installed renewable electricity.

| FY2015 (baseline year) |

FY2022 | FY2025 (target year) |

|

|---|---|---|---|

| Number of properties (Note 1) | 30 | 41 | - |

| CO2 emissions from electricity (Note 2) | 23,281.9 | 21,911.2 | 0 |

| Vs. FY2015 | - | 94% | 0% |

| (Note 1) | Excluding co-owned, sectionally owned, and land-only properties that have not installed renewable electricity. For FY2015, the figure is the number of properties from which data were possible to be collected. |

|---|---|

| (Note 2) | For FY2015, figure is calculated based on the 30 properties from which data were possible to be collected. |

Green-certified assets

For details of each certification, please refer Environmental Certifications.

- Target

70% or more green-certified assets by 2030 - Excludes the properties in which API owns only land.

| End of November 2021 (reference) |

End of May 2023 | End of November 2023 | 2030 (target year) | |

|---|---|---|---|---|

| Number of properties(Note) | 45 | 45 | 44 | - |

| Of which are green-certified properties | 29 | 35 | 35 | - |

| Certification acquisition rate (GFA based) |

65% | 71% | 74% | More than 70% |

| (Note) | Excluding land-only properties. |

|---|

Green Clause in lease agreement

For details of green lease agreement, please refer 4. Green Lease Agreement in Initiatives to Reduce Environmental Impact.

- Target

Promote green leases for 100% of new contracts - Excluding contracts for temporary use and residential lease contracts.

| FP ended November 2021 (reference) |

FP ended May 2023 | FP ended November 2023 | |

|---|---|---|---|

| Number of new lease agreements concluded during fiscal period | 62 | 38 | 46 |

| Of which include green clauses | 62 | 38 | 46 |

| Green lease agreements rate | 100% | 100% | 100% |

| (Note) | Excluding contracts for temporary use and residential lease contracts. |

|---|

Green Bond

For details of API’s green bond, please refer Green Bonds.

- Target

100% of new issuances of investment corporation bond to be green bonds - On the condition of issuance based on the current framework.

| FP ended November 2021 (reference) |

FP ended May 2023 | FP ended November 2023 | |

|---|---|---|---|

| Amount of investment corporation bonds issued during fiscal period | ¥3,900 million | ¥2,000 million | ¥ 0 million |

| Of which are green bonds | ¥3,900 million | ¥2,000 million | ¥ 0 million |

| Green Bond rate | 100% | 100% | - |

Environmental Certifications

CASBEE

CASBEE (Comprehensive Assessment System for Built Environmental Efficiency) is a system that evaluates and rates the environmental performance of buildings, including aspects of environmental load reduction such as energy saving, resource saving, and recycling performance, as well as biodiversity and indoor environmental considerations.

The evaluation results are graded in four levels from B (★★) to S (★★★★★).

BELS

BELS assessment is provided under a public evaluation system, which evaluates the energy conservation performance of houses and buildings, established by the Ministry of Land, Infrastructure, Transport and Tourism. Third parties evaluate the performance of buildings based on the primary energy consumption defined in energy saving act (Note), regardless of whether a building is new or not, and the evaluation result is represented by a number of stars (from one "★" to five stars "★★★★★").

BELS assessment, which is the first public evaluation system specific to energy conservation performance in Japan, is expected to promote further improvements by providing appropriate information and promoting the energy conservation performance of buildings.

| (Note) | Act on the Rational Use of Energy |

|---|---|

| (Note) | Evaluator: Japan ERI Co., LTD |

|---|---|

Website of BELS(Japanese only)

DBJ Green Building Certification

DBJ Green Building Certification, offered by Development Bank of Japan Inc. (DBJ), is a comprehensive evaluation system which includes not only an environmental perspective but also a social one (owner response to social needs of the diverse stakeholders of the properties), DBJ identifies and certifies "Green Buildings", which are essential in today's real estate market.

Consideration to Urban Greening and Biodiversity

In management of the properties, API is committed to biodiversity conservation through the preservation and improvement of urban green spaces and natural ecosystems on or adjacent to its properties.

Tokyu Plaza Omotesando “Omokado” acquired ABINC certification for its efforts to create large-scale indoor greening and an environment that is hospitable to living creatures.

We are also actively introducing rooftop greening and wall greening at several of our office buildings.

Environmental Consideration in Real Estate Investment

In principle, properties in which API invests must comply with the Air Pollution Control Law, the Soil Contamination Countermeasures Law, and other relevant laws and regulations regarding the use of hazardous substances (asbestos, PCBs, CFCs, etc.) in buildings and soil conditions on the premises, or have measures in place to deal with such substances.

During due diligence at the time of acquisition, all properties are investigated by a third party to determine whether or not hazardous substances are used in the building and to assess the environmental risks associated with soil contamination before making an investment decision.

Urban Redevelopment

Brownfield redevelopment

Amagasaki Q's MALL (Land)

The property is a large shopping mall constructed through redevelopment of a former factory site. Chemicals detected in the soil contamination risk assessment on the site were removed by excavation before redevelopment.

Asset-recycling model with the Sponsor

As the support from the Sponsor for external growth, in addition to the "fund-recycling model" in which API acquires an asset from the sponsor through fund procurement, API is also promoting the "asset-recycling model" through asset replacement with the Sponsor. By utilizing the Sponsor's redevelopment function, not only that the assets that API dispose will be put back into the pipeline after redevelopment by the Sponsor, but API also plays a part in the urban redevelopment by the Sponsor.

Tokyu Plaza Akasaka (disposed in October 2021)

A hotel representing the area facing the Akasaka-mitsuke intersection, which was over 50 years old, was transferred to the Sponsor. Not only that the preferential negotiation rights for the new property in the event that the hotel will be redeveloped by the Sponsor that API has acquired will contribute to API's future external growth, but API will also play a role in urban redevelopment as a part of the Sponsor's cyclical reinvestment business.