- Home

- Sustainability

- Materiality

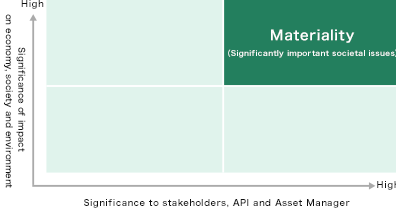

Materiality

Materiality Identification

In line with the Policy and as a member of the Group, TRM recognized the material issues of the Group* and identified its own materiality issues by extracting societal items which are important over the medium to long term for a sustainable society, with consideration to the environmental efforts API has already made. This Materiality is shared between TRM and API. * The material issues of the Group at the time of the materiality identification for API and TRM.

Identification process

Materiality was identified by select cross-divisional members of TRM.

Awareness and organization of social issues

In preparing discussions for Materiality, societal issues related to API and TRM were extracted by referencing the Group Integrated Report; materiality; GRI Standards; relevant SDGs; ESG assessments for the real estate sector; and issues recognized by the industry association.

Integration and consolidation of issues

With respect to the above stated societal issues, existing efforts by API and TRM were summarized, and a materiality short list was created by discussing topics that should be given more significance, with additional consideration to risks and opportunities regarding each issue.

Reflection of opinions from officers and employees

All officers and employees were asked to offer opinions as stakeholders of TRM, and preliminary interview was conducted with Executive Director and Supervisory Directors of API.

Identification of Materiality

Based on the interview results, significance of each issue to be addressed by API and TRM was reviewed for appropriateness.

Materiality was identified by the Sustainability Promotion Council and reported to the board of directors of TRM and API.

SDGs strongly linked to our Materiality

The Materiality that API shares with TRM reflects the magnitude of impact our actions will have on the relevant risks and opportunities. Our aim is to contribute to the Sustainable Development Goals (SDGs) through our approaches to the Materiality.

| Materiality | Risks (Impact of not addressing materiality) |

Opportunities (Business opportunities expected by addressing materiality) |

Relevant SDGs |

|---|---|---|---|

| Reducing environmental impact | Increased physical risk from escalation of climate change (human damage, property damage, economic damage), risks associated with a transition to a decarbonized society |

・Sharing and executing clear commitment to ESG investment with officers and employees should provide opportunities to implement such actions into our business strategy

・Increased demand for leasing properties focused on environmental performance

|

|

| Human capital development as a group of professionals |

Failure to implement a human resources strategy that is based on respect for human rights and that takes into account the perspectives of diversity, equity, and inclusion, or lack of sufficient skilled resources may hinder business operation, leading to stagnant or lower investor values | Each employee’s effort to further realize their abilities and maintain mental health and stable living while fulfilling the fiduciary duty required of asset management business and working towards our goal of maximizing unitholder value and enhancing our presence, as we implement human capital management, will create a positive cycle and improve our performance | |

| Contribution to the local communities |

・Breakdown of communication with local community at the times of emergency such as disaster may cause reputation risk

・Risk of loss of liveliness due to the image of the invested region becoming obsolete or due to population decrease |

Show presence by contributing to the safety and security of the region and vitalization of local economy as a member of a corporate group committed to urband development | |

| Health and well-being of tenants | Facilities with inferior ESG considerations may have risk of losing support from tenants | Contract renewal and repeated selection for relocation by tenants can be expected by creating safe, comfortable and pleasant space for tenants | |

| Supplier engagement | Impact on management operation and deteriodated credit in case of significant violation against sustainable procurement such as discrimination, exploitation, destruction of nature, contamination and violation of laws by suppliers are recognized | Collaborate with suppliers to make transactions that take into consideration human rights and satisfy fiduciary duty required of asset management business and contribute to becoming the REIT of choice by the investors | |

| Management framework corresponding to multifaceted social demand towards sustainable society | Imappropriate response to multifaceted social demands may risk fail in trust concerning sound and effective management business and affect market development | Enhanced commitment from the perspective of respecting human rights to environmental issues including climate change and social issues such as human capital management and supply chain management will further promote establishment of medium- to long-term business platform, and improvement in financial value can be expected |

Sustainable Development Goals (SDGs)

The United National Sustainable Development Summit was held from 25 to 27 September 2015 at the United Nations headquarters in New York with participation by leaders from more than 150 member countries, and adopted the resolution, “Transforming our world: the 2030 Agenda for Sustainable Development.” At the same time, a declaration and goals were announced as an action plan for people, planet and prosperity. They were the Sustainable Development Goals (SDGs) comprising of 17 goals and 169 targets.