- Home

- API Features

- API Features

- Governance Structure To Maximize Unitholder Value

API Features

- Urban Retail and

Tokyo Office Properties - Tokyu Fudosan Holdings Group's

Comprehensive Value Chain - Governance Structure To

Maximize Unitholder Value

Governance Structure To Maximize Unitholder Value

Along with utilizing the value chain of the Tokyu Fudosan Holdings Group, we have a Governance Structure To Maximize Unitholder Value that maximizes unitholder value by taking steps to avoid conflicts of interest in transactions with related parties and aligns the interests of unitholders and Tokyu Land Corporation, and a management fee system that includes asset management fees based on distribution per unit.

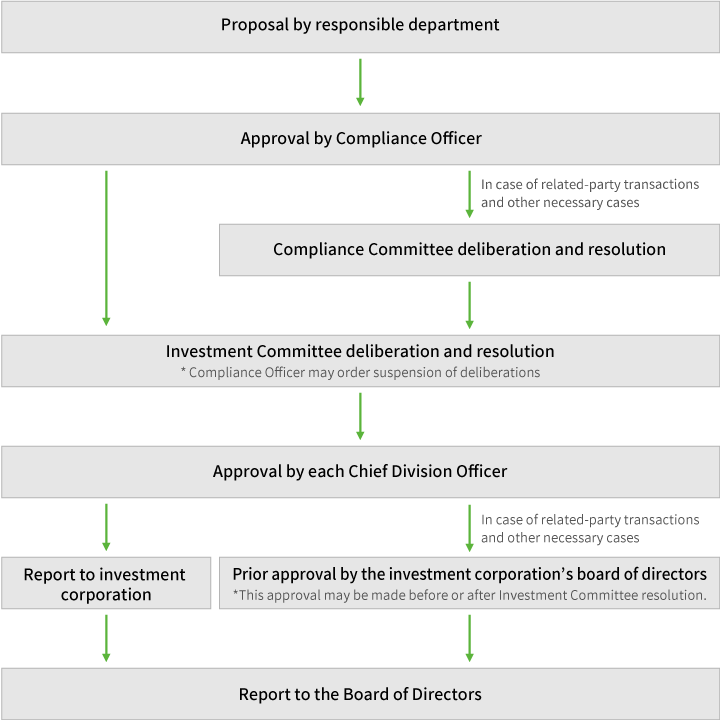

Impartiality in asset acquisitions to avoid conflicts of interest and protect the interests of unitholders

Related-party transactions, including asset acquisitions, require resolutions of the Compliance Committee and the board of directors of Activia Properties Inc.

Alignment of the interests of the unitholders and Tokyu Land Corporation

To align the interests of the unitholders and Tokyu Land Corporation, establish a structure in which Tokyu Land Corporation and Activia Properties Inc. can coordinate their operations, and increase the interests of Tokyu Land Corporation and Activia Properties Inc., we have agreed with Tokyu Land Corporation on the following:

Tokyu Land Corporation's investment in Activia Properties Inc.

| After the listing | Tokyu Land Corporation holds about 10% of the issued units |

|---|

In the sponsor support agreement between Tokyu Land Corporation and the asset manager, Tokyu Land Corporation states the following about the units issued by Activia Properties Inc.:

| 1. | Tokyu Land Corporation intends to own approximately 10% of the units newly issued when we are listed. |

|---|---|

| 2. | Tokyu Land Corporation intends to hold the units for at least five years, either directly or through its affiliates. |

| 3. | Tokyu Land Corporation intends to consider in good faith further acquisitions of our units in the event that we conduct further offerings. |

Common ownership of properties with the Sponsor

We believe that we can align our interests in operating individual properties with Tokyu Land Corporation's interests by jointly owning properties.

| We have acquired 75% of the trust beneficiary co-ownership interest (jun kyoyu-mochibun), and a special purpose company in which Tokyu Land Corporation has preffered equity holds the remaining 25%. | |

| We have acquired 49% of the trust beneficiary co-ownership interest (jun kyoyu-mochibun), and Tokyu Land Corporation holds the remaining 51%. | |

| We have acquired 60% of the trust beneficiary co-ownership interest (jun kyoyu-mochibun), and Tokyu Land Corporation holds the remaining 40%. |

Management fee system, including asset management fees based on distribution per unit.

Under our Articles of Incorporation and asset management agreement, the asset management fees that we pay to the asset manager partly depend on our distributions per unit. Asset management fees based on distributions per unit give the asset manager an incentive to maximize unitholder value.

| Asset management fees | ||

|---|---|---|

| Type 1 management fee (annual rate) |

Type 2 management fee | |

| Method of calculation and rate (note) |

Total assets at the end of the previous fiscal period × 0.25% |

Distribution per unit before the deduction of the type 2 management fee × NOI × 0.00021% |

| The upper limit of the sum of the type 1 management fee and the type 2 management fee is the total assets at the end of the fiscal period multiplied by 0.5% | ||

| (Note) | The rate for the type 1 management fee shall be 0.3% or less. |

|---|

| Acquisition fee and disposition fee | |

|---|---|

| Acquisition fee | Disposition fee |

| 0.7% Related party:0.5% |

0.5% Related party: 0 If a disposal loss is incurred, there will be no disposition fees. |

- Related Page

- Summary of Asset Manager